Australians may avoid a potential interest rate increase next month as new data reveals a further deceleration of inflation, although the decision is expected to be a "tight call".

The Target Cash Rate was 0.10% in April last year; it is now 3.60%. Interest Rates on home loans have basically doubled in less than a year, from about 2.8% to about 5.7%.

This dramatic increase in lending rates has been impacting the Melbourne property market in several ways.

Existing property owners are now paying much more on mortgage repayments. Someone with a typical mortgage of $650,000 has seen his/her repayments gradually increase from about $2,700 each month to about $3,800. Owners with fixed-interest loans about to roll over are in for a shock. Some vendors are motivated to sell due to financial pressures.

Because of these increased lending costs (and the buffers that banks put in place related to future potential increases), the borrowing capacity of new homebuyers is much lower than it once was. The amount that many buyers can pay for properties is down.

Nobody knows for certain how many more times interest rates will rise when they will stabilise, and at what level. The RBA’s pandemic guidance that interest rates would not rise until at least 2024 proved irresponsible. It has previously noted that it “expects that further tightening of monetary policy will be needed to ensure that inflation returns to target”. Some prospective homebuyers – owner occupiers and investors alike – are sitting on their hands.

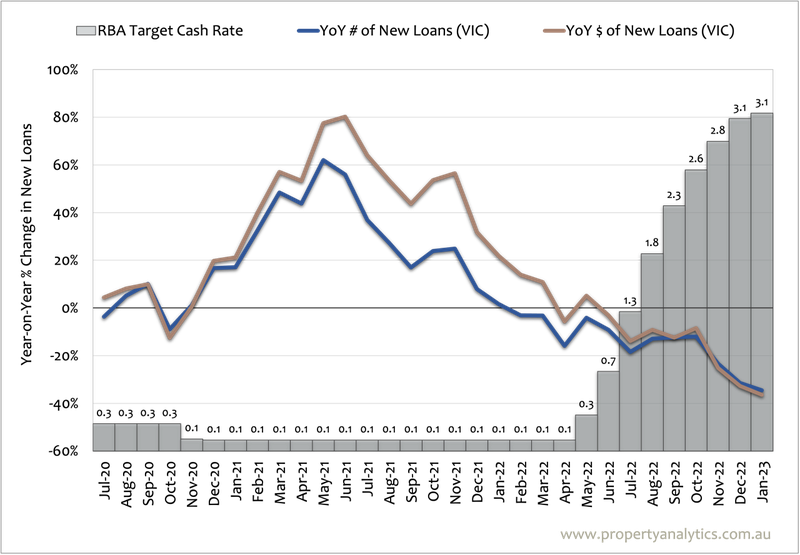

The above graph shows how loan activity has changed over the last few years in Victoria. The blue line shows the Year-on-Year % Change in the # of New Loans in Victoria, and the red line shows the change in the $ of New Loans. The grey bar shows lending rates.

In a climate of stable, record-low lending rates, the Melbourne property market ran hot in the middle of 2021; the volume and value of new loans were up dramatically from the previous year.

Slowly, lending activity started to flatten as the market ran out of steam. By early 2022, the volume and value of new lending were lower than the previous year. Lending rates then started rising in response to high inflation; the volume and value of lending in Victoria have gradually fallen to now sit nearly 40% lower than the previous year.

The combination of more motivated sellers with fewer, cost-conscious buyers has naturally led to lower property prices across Melbourne.

But a large portion of sellers aren’t under financial pressure – they’re selling for typical reasons like wanting more space, less maintenance, or better access to lifestyle amenities. Similarly, many buyers are in strong financial positions with minimal borrowing requirements.

In this context, the Melbourne property market is surprisingly patchy.

Quality, modern homes in good locations are selling very well. Over the last 12 months, Nelson Alexander’s Auction Success Rate was a healthy 73% - nearly 3 in 4 properties that Nelson Alexander took to auction sold under competition between multiple buyers.

Tired properties with obvious drawbacks are in less demand from investors and renovators. They need to be priced correctly, often with an alternative selling method. Over the last 12 months, Nelson Alexander sold nearly 1500 properties via Private Sales - sometimes with multiple interested buyers, but often through good faith one-on-one negotiations.

Rising interest rates naturally contribute to a softening property market. It is reasonable to assume that rates will rise further in the coming months, but that the bulk of increases are likely behind us. History has shown that the direction of interest rates impacts on the Melbourne property market more than the actual level of interest rates. Once rates stabilise, expect property prices to respond in kind.

For further information on how your property is placed in today’s market, visit our latest Suburb Report here, fill out the form below or reach out to any of Nelson Alexander’s agents for a confidential discussion.